Daily Top 5 Daily Top 5 |

Tata's digital splurge continues

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.

We reported last month that Tata Digital was looking to invest in health and fitness startup CureFit. The $75-million deal came through earlier today, giving the Tatas another arrow in their digital quiver to take on the likes of Amazon, Reliance and Flipkart.

Also in this letter:

💸 India to push for Big Tech tax

📱 Google to change its ad practices

⬇️ Bitcoin falls after China crackdown

GIF Credit: Giphy

GIF Credit: Giphy

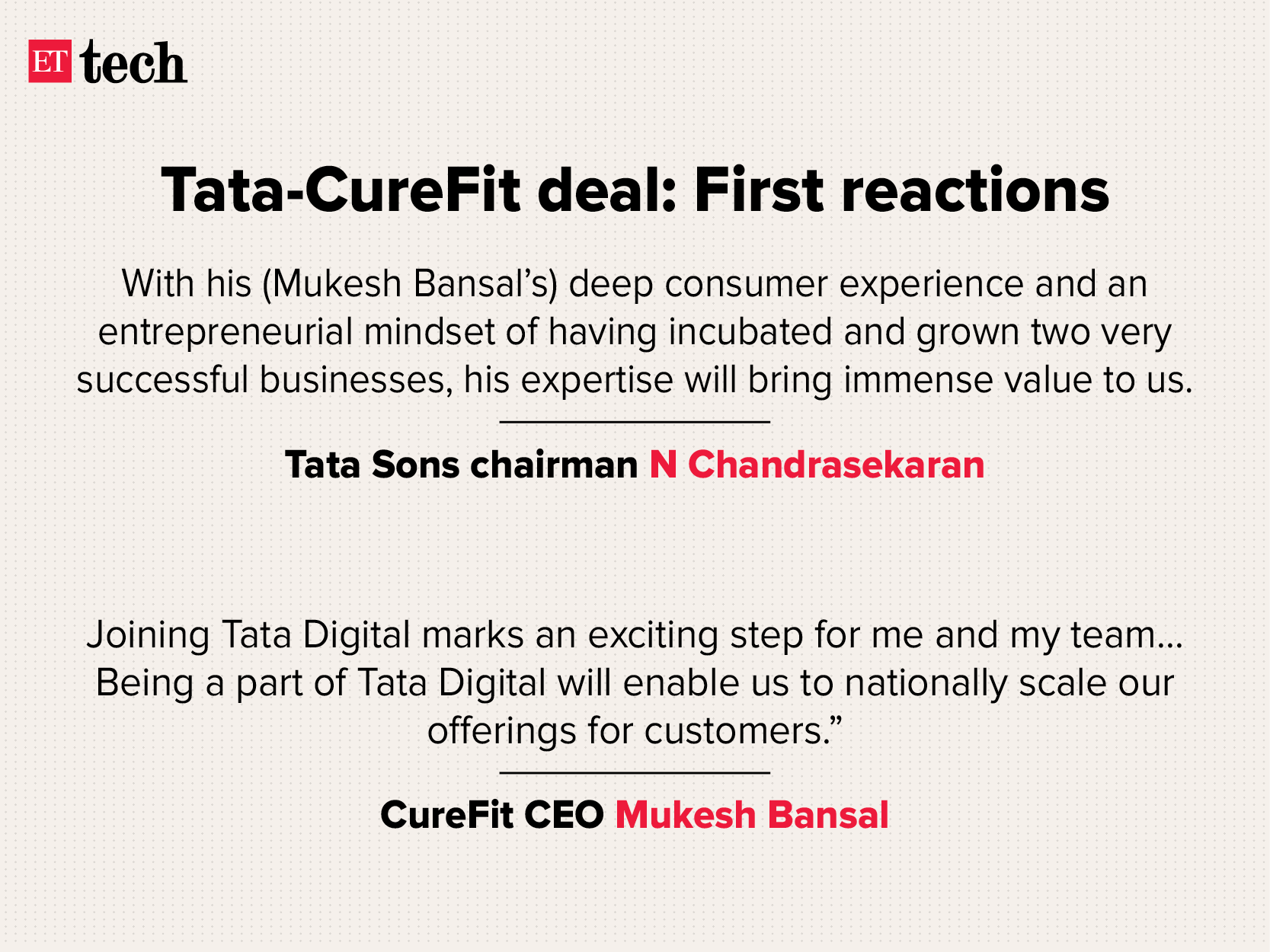

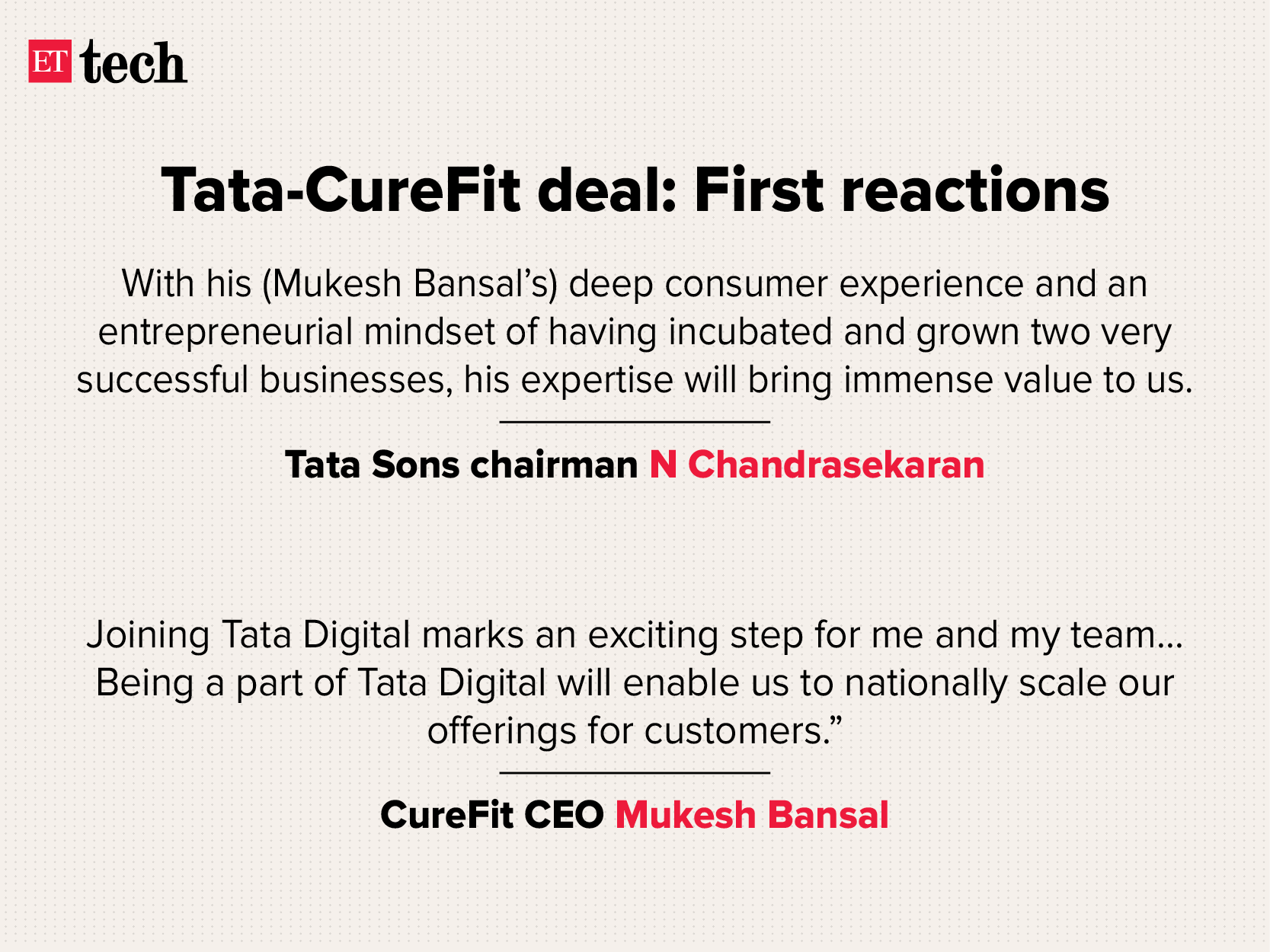

Tata Digital is investing $75 million in health and fitness startup CureFit. The deal was first reported by ET last month.

Tata's digital play: This deal comes as Tata is building its digital arsenal against the likes of Amazon, Reliance and Walmart-Flipkart. Last fortnight, Tata's digital subsidiary announced its purchase of a 64% stake in online grocer BigBasket, in one of the largest M&A deals in India's digital sector. It is also in the final stages of acquiring online pharmacy 1mg.

Curefit is expected to help Tata Digital expand into pro-active health management. As part of the deal, CureFit founder Mukesh Bansal will join Tata Digital as president, in addition to his leadership role at the startup.

The RNT connection: Bansal and Curefit already have an association with the Tata group. When the startup was just a year old, Tata Sons chairman emeritus Ratan Tata had invested in Curefit through his UC RNT Fund, formed by Tata in partnership with the University of California Investments. Through this, Tata had led a $3 million funding round in Curefit in 2017.

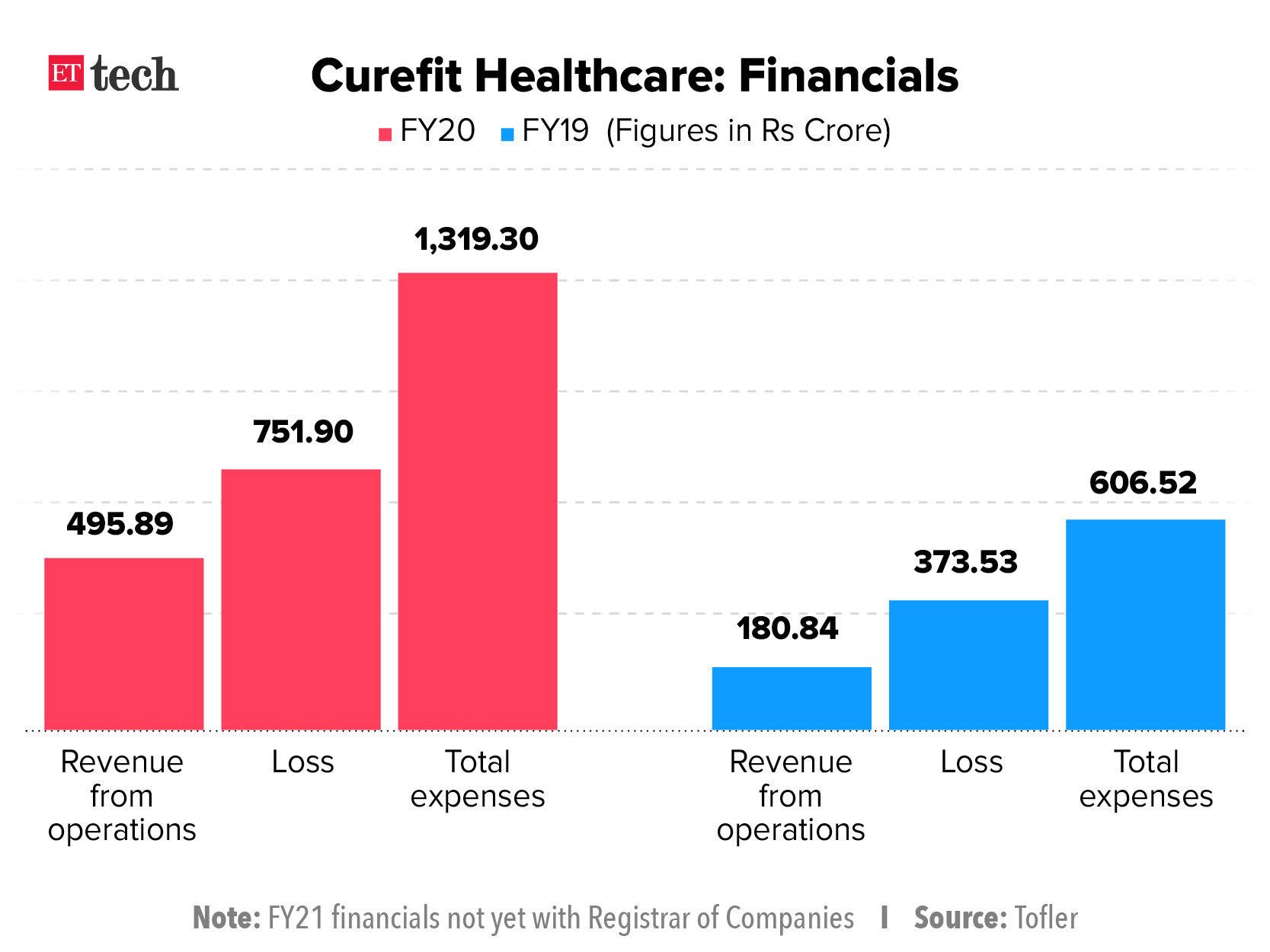

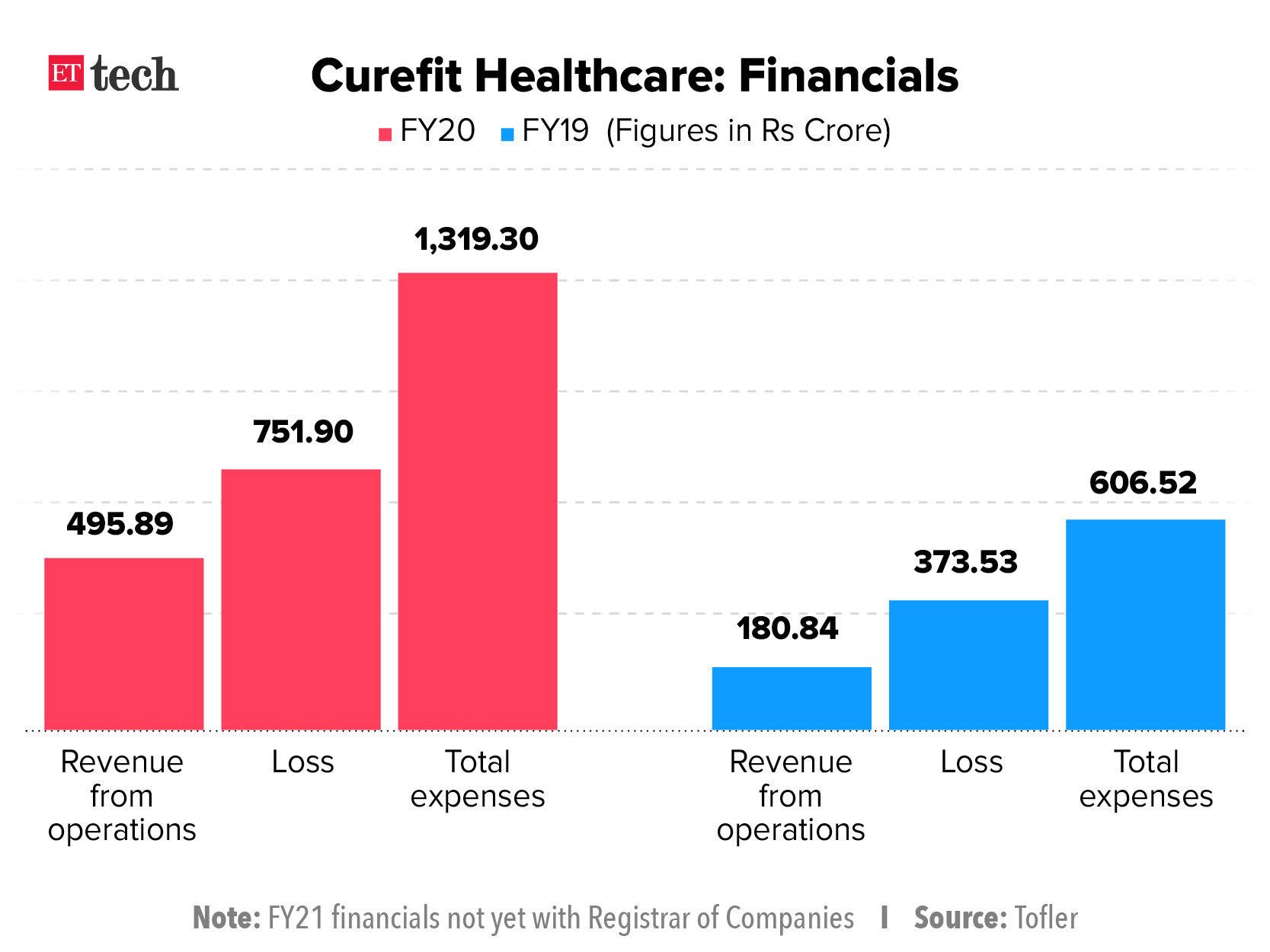

Curefit, which was recently rebranded to Cult.Fit, had raised a total $418 million prior to this deal and was last valued at around $800 million. It counts Temasek, Accel, Kalaari Capital among its investors.

Impact of the pandemic: Curefit's core business of offering fitness sessions through gyms has been hit hard by the pandemic. Last May, the company let go 800 of its employees and announced pay cuts across levels as its gyms remained shut amid the first wave of the Covid-19 pandemic. In the following months, it furloughed another 500 of its employees, exited smaller cities, and cancelled plans to expand to foreign markets such as the UAE.

After restarting its physical operations late last year, the second wave again forced the company to shut its gyms. The company has since tried shifting its fitness and gym business online through streaming sessions.

India would be able to impose a 20% tax on the net profits of large tech companies that operate in the country but don’t have a physical presence here if a deal struck by the Group of Seven (G7) advanced economies over the weekend could be agreed upon globally.

The union government is yet to take a view on the G7 deal, but it will be discussed by the G20 group that includes India and China next month in Venice.

Background: On June 5, the G7 secured a landmark deal on taxing multinational companies, setting the minimum global tax rate at 15%.

The agreement by finance ministers of US, UK, Germany, France, Canada, Italy and Japan paves way for taxes on multinationals in countries where they operate, instead of just where they are headquartered.

The deal follows years-long efforts by several countries to revamp international tax laws and reduce the incentive for large tech firms to shift profits to offshore tax havens.

Under the deal, market countries or countries where digital multinationals have a huge user base, will be awarded taxing rights on at least 20% of profits exceeding a 10% margin for the largest and most profitable multinational enterprises, according to Reuters.

Where India stands: India currently levies a 6% equalisation levy on the advertising revenue of large multinationals, such as Google and Facebook.

Over the next few months, the country is expected to push for its right to tax MNCs at a higher rate in the Organisation for Economic Co-operation and Development (OECD). India’s case is that the size of the user base must be taken into consideration when deciding the tax rate, ET reported earlier today.

This is because while many Indians use these companies’ services, the country contributes a tiny portion of their revenues.

What are companies saying? Facebook welcomed the G7 deal, with its head of global affairs Nick Clegg calling it a "significant first step towards certainty for businesses and strengthening public confidence in the global tax system”.

Yes, but: Analysts told Reuters the tax deal wouldn't hurt companies unless it was agreed with tax-haven countries such as Ireland, which has seen a huge influx of investment from multinationals due to lower taxes. Ireland continues to make its case that any final deal must meet the needs of small and large countries.

With the complexity of modern applications and the tech stacks that support them, monitoring to identify, debug, and resolve issues becomes an interesting challenge.

As Ariel Assaraf, CEO of Coralogix, wrote in Information Weekly, “the adverse effects of tool sprawl include the reduced speed of innovation, siloed data and lack of integration, and most concerning, reduced productivity.”

Coralogix addresses this issue of tool sprawl by giving DevOps full observability to optimize their systems and processes while saving time and money

The Department of Telecommunications (DoT) will shortly ask the Telecom Regulatory Authority of India (TRAI) to unveil a comprehensive discussion paper on a new licensing framework for operators of low earth orbit (LEO) satellite constellations such as SpaceX, people familiar with the matter told ET.

"The paper will seek industry views on whether a new category of licences must be created for LEO players operating satellite gateways in India, or whether the scope of existing satcom permits and processes need to be widened and simplified to accommodate them," a source told ET.

The move as several prominent players -- Bharti Group-backed OneWeb, Elon Musk’s SpaceX and Amazon -- are gearing up to launch high-speed satellite internet services in the country. Read our recent deep-dive into SpaceX’s satellite-powered internet service Starlink, its advantages and disadvantages, and the competition it faces.

In April, several satellite internet players had proposed various measures to the Telecom Regulatory Authority of India (TRAI) to reduce the cost of satellite broadband services and make them available for mass consumption. They had also sought to break up the roles of licensor, regulator and satellite operator, which is currently under the Department of Space, in favour of a model similar to the one for telecom.

What's at stake? India has emerged as a critical satellite internet market for these companies, with a $500 million near-term revenue opportunity. Nearly 75% of the rural population does not have access to broadband internet.

Bezos prepares for blast-off: Meanwhile, Amazon founder Jeff Bezos said he and his brother Mark Bezos will be among the passengers on board New Shepard, the first human spaceflight of his rocket company Blue Origin, which is set to take off on July 20.

The firm is also auctioning off a passenger seat on the spaceflight, the bidding for which has almost hit $3 million, with nearly 6,000 participants from 143 countries.

China is stepping up its crackdown on Bitcoin trading and mining, leading to a further slide in the cryptocurrency’s price over the weekend.

What happened: The country's Twitter clone Weibo blocked several prominent crypto-related accounts, saying each of them “violates laws and rules”. There is more in store, including linking illegal crypto activities in China more directly with the country’s criminal law, analysts and a financial regulator told Reuters.

Last month, Chinese Vice Premier Liu He and the State Council had said it was necessary to “crack down on Bitcoin mining and trading behavior, and resolutely prevent the transmission of individual risks to the social field”.

Following this statement, cryptocurrency miners halted all or part of their China operations. Chinese miners account for as much as 70% of the global crypto supply.

Today’s ETtech Top 5 was written by Vikas SN in Bengaluru and edited by Zaheer Merchant in Mumbai.

Also in this letter:

💸 India to push for Big Tech tax

📱 Google to change its ad practices

⬇️ Bitcoin falls after China crackdown

Tata boosts digital arsenal with $75 million in CureFit

Tata Digital is investing $75 million in health and fitness startup CureFit. The deal was first reported by ET last month.

Tata's digital play: This deal comes as Tata is building its digital arsenal against the likes of Amazon, Reliance and Walmart-Flipkart. Last fortnight, Tata's digital subsidiary announced its purchase of a 64% stake in online grocer BigBasket, in one of the largest M&A deals in India's digital sector. It is also in the final stages of acquiring online pharmacy 1mg.

Curefit is expected to help Tata Digital expand into pro-active health management. As part of the deal, CureFit founder Mukesh Bansal will join Tata Digital as president, in addition to his leadership role at the startup.

- Bansal had previously co-founded online fashion retailer Myntra, which was later acquired by Flipkart. He launched the venture with former Flipkart top executive Ankit Nagori in 2016 and has been running Curefit for the past five years. Last year, Nagori exited Curefit to solely take care of the company's food business, Eat.Fit.

The RNT connection: Bansal and Curefit already have an association with the Tata group. When the startup was just a year old, Tata Sons chairman emeritus Ratan Tata had invested in Curefit through his UC RNT Fund, formed by Tata in partnership with the University of California Investments. Through this, Tata had led a $3 million funding round in Curefit in 2017.

Curefit, which was recently rebranded to Cult.Fit, had raised a total $418 million prior to this deal and was last valued at around $800 million. It counts Temasek, Accel, Kalaari Capital among its investors.

Impact of the pandemic: Curefit's core business of offering fitness sessions through gyms has been hit hard by the pandemic. Last May, the company let go 800 of its employees and announced pay cuts across levels as its gyms remained shut amid the first wave of the Covid-19 pandemic. In the following months, it furloughed another 500 of its employees, exited smaller cities, and cancelled plans to expand to foreign markets such as the UAE.

After restarting its physical operations late last year, the second wave again forced the company to shut its gyms. The company has since tried shifting its fitness and gym business online through streaming sessions.

After G7 deal, India to push for taxing Big Tech next month

India would be able to impose a 20% tax on the net profits of large tech companies that operate in the country but don’t have a physical presence here if a deal struck by the Group of Seven (G7) advanced economies over the weekend could be agreed upon globally.

The union government is yet to take a view on the G7 deal, but it will be discussed by the G20 group that includes India and China next month in Venice.

Background: On June 5, the G7 secured a landmark deal on taxing multinational companies, setting the minimum global tax rate at 15%.

The agreement by finance ministers of US, UK, Germany, France, Canada, Italy and Japan paves way for taxes on multinationals in countries where they operate, instead of just where they are headquartered.

The deal follows years-long efforts by several countries to revamp international tax laws and reduce the incentive for large tech firms to shift profits to offshore tax havens.

Under the deal, market countries or countries where digital multinationals have a huge user base, will be awarded taxing rights on at least 20% of profits exceeding a 10% margin for the largest and most profitable multinational enterprises, according to Reuters.

Where India stands: India currently levies a 6% equalisation levy on the advertising revenue of large multinationals, such as Google and Facebook.

Over the next few months, the country is expected to push for its right to tax MNCs at a higher rate in the Organisation for Economic Co-operation and Development (OECD). India’s case is that the size of the user base must be taken into consideration when deciding the tax rate, ET reported earlier today.

This is because while many Indians use these companies’ services, the country contributes a tiny portion of their revenues.

What are companies saying? Facebook welcomed the G7 deal, with its head of global affairs Nick Clegg calling it a "significant first step towards certainty for businesses and strengthening public confidence in the global tax system”.

Yes, but: Analysts told Reuters the tax deal wouldn't hurt companies unless it was agreed with tax-haven countries such as Ireland, which has seen a huge influx of investment from multinationals due to lower taxes. Ireland continues to make its case that any final deal must meet the needs of small and large countries.

Tweet of the day

MESSAGE FROM CORALOGIX

CORALOGIX: Simplifying technology systems

CORALOGIX: Simplifying technology systems

With the complexity of modern applications and the tech stacks that support them, monitoring to identify, debug, and resolve issues becomes an interesting challenge.

As Ariel Assaraf, CEO of Coralogix, wrote in Information Weekly, “the adverse effects of tool sprawl include the reduced speed of innovation, siloed data and lack of integration, and most concerning, reduced productivity.”

Coralogix addresses this issue of tool sprawl by giving DevOps full observability to optimize their systems and processes while saving time and money

DoT to seek TRAI’s view on rules for satellite internet firms

The Department of Telecommunications (DoT) will shortly ask the Telecom Regulatory Authority of India (TRAI) to unveil a comprehensive discussion paper on a new licensing framework for operators of low earth orbit (LEO) satellite constellations such as SpaceX, people familiar with the matter told ET.

"The paper will seek industry views on whether a new category of licences must be created for LEO players operating satellite gateways in India, or whether the scope of existing satcom permits and processes need to be widened and simplified to accommodate them," a source told ET.

The move as several prominent players -- Bharti Group-backed OneWeb, Elon Musk’s SpaceX and Amazon -- are gearing up to launch high-speed satellite internet services in the country. Read our recent deep-dive into SpaceX’s satellite-powered internet service Starlink, its advantages and disadvantages, and the competition it faces.

In April, several satellite internet players had proposed various measures to the Telecom Regulatory Authority of India (TRAI) to reduce the cost of satellite broadband services and make them available for mass consumption. They had also sought to break up the roles of licensor, regulator and satellite operator, which is currently under the Department of Space, in favour of a model similar to the one for telecom.

What's at stake? India has emerged as a critical satellite internet market for these companies, with a $500 million near-term revenue opportunity. Nearly 75% of the rural population does not have access to broadband internet.

Bezos prepares for blast-off: Meanwhile, Amazon founder Jeff Bezos said he and his brother Mark Bezos will be among the passengers on board New Shepard, the first human spaceflight of his rocket company Blue Origin, which is set to take off on July 20.

The firm is also auctioning off a passenger seat on the spaceflight, the bidding for which has almost hit $3 million, with nearly 6,000 participants from 143 countries.

- Bezos is stepping down as Amazon CEO on July 5 and will become the company's executive chairman. Current AWS chief executive Andy Jassy will be taking over as the new Chief executive of Amazon.

Bitcoin falls after another crackdown in China

China is stepping up its crackdown on Bitcoin trading and mining, leading to a further slide in the cryptocurrency’s price over the weekend.

What happened: The country's Twitter clone Weibo blocked several prominent crypto-related accounts, saying each of them “violates laws and rules”. There is more in store, including linking illegal crypto activities in China more directly with the country’s criminal law, analysts and a financial regulator told Reuters.

Last month, Chinese Vice Premier Liu He and the State Council had said it was necessary to “crack down on Bitcoin mining and trading behavior, and resolutely prevent the transmission of individual risks to the social field”.

Following this statement, cryptocurrency miners halted all or part of their China operations. Chinese miners account for as much as 70% of the global crypto supply.

Today’s ETtech Top 5 was written by Vikas SN in Bengaluru and edited by Zaheer Merchant in Mumbai.

Want this newsletter delivered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Daily Top 5

We'll soon meet in your inbox.