Seven Republican super-donors helped bankroll the conservative push for power in the 2016 election cycle, between them pumping more than $350m (£264m) into federal and state races.

The Paradise Papers illuminate another aspect of these vastly wealthy men – their propensity to nurture offshore some of their combined fortunes, estimated by Forbes at $142bn, largely beyond the reach of public scrutiny and tax authorities.

The seven have their divisions, especially over Donald Trump. Warren Stephens was a major backer of the Stop Trump movement last year, while Geoff Palmer was among the then Republican nominee’s biggest financial backers.

But they share a presence in tax havens. In turn, they face a legitimate question as they wield influence by investing in Super Pacs with names including “Rebuilding America now”, “Right to rise USA” and “American unity”: are their political principles undermined by their offshore practices?

Warren Stephens

Stephens, a major Republican donor, was the hidden co-owner of a payday lending company US authorities are suing for $50m after it allegedly used predatory tactics to deceive customers about the true cost of their loans.

He is identified in the leaked documents as one of the two main owners of a group of short-term lenders including Integrity Advance, which is accused of violating federal laws.

The Paradise Papers reveal that the billionaire financier, based in Arkansas, holds a 40% stake in the lender’s parent company, which donated widely to US political campaigns over recent years while its link to Stephens was generally unknown.

Since 2015, Integrity Advance has been fighting a legal action brought against it by the Consumer Financial Protection Bureau, a financial industry watchdog.

Integrity Advance is accused by the CFPB of hiding the scale of fees consumers would face if they failed to repay their loans on time. The tactic meant some defaulting customers who had taken out typical $300 loans ended up having to pay $765 (255%) in interest and fees on top of what they borrowed, according to the watchdog.

The lender is also alleged to have used hidden provisions to continue removing money from customers’ bank accounts even after they had blocked payments, including during disputes over how much they owed.

The CFPB’s lawsuit says Integrity Advance and its CEO, James Carnes, broke the Truth in Lending Act, the Electronic Fund Transfer Act, and sections of the Dodd-Frank Act passed following the 2008 financial crisis that outlaw deceptive business practices.

Stephens, 60, has repeatedly criticised the agency for restricting the freedom of corporations.

The leaked files show Stephens held his stake in Integrity Advance through SI Hayfield, a company he formed in 2008 with an initial investment of $17.2m. The majority of this was funded by Stephens, his wife, Harriet, and their children’s trust fund. The golfer Phil Mickelson also invested $12,000.

According to Federal Election Commission records, Stephens has contributed at least $19.7m to campaign committees and national election candidates, including Mitt Romney, Marco Rubio and Chris Christie. He opposed Trump’s 2016 campaign.

In an email, a spokesman said Stephens declined to comment.

Charles and David Koch

The shadow of the Koch brothers has fallen across the US political landscape for decades, as they have made huge donations in an attempt to push the Republicans further to the right.

Charles and David Koch control Koch Industries, the second largest privately held company in the US. In 2005, they bought the paper and pulp giant Georgia-Pacific for $21bn.

The Kochs took their new holding private, and in doing so shut the door on public access to information about its internal workings. The Paradise Papers open that door, giving a glimpse of how Georgia-Pacific conducts its affairs offshore.

Within months of the company being acquired by the Kochs, it relocated millions of dollars of profits from high-tax jurisdictions such as the US and UK to low-tax environments in Luxembourg and the offshore haven Bermuda.

At the center of the money shuffle was Georgia-Pacific Britain Ltd, a subsidiary leasing paper production equipment, which was incorporated in Bermuda but controlled and managed out of the UK.

Shortly after the Kochs bought Georgia-Pacific, the subsidiary found itself under pressure from UK tax authorities to settle a dispute over the leasing of a paper mill, at which point directors began discussing the possibility of “exiting the UK”.

In the ensuing months, the management of Georgia-Pacific Britain passed from the UK to Bermuda.

Two huge loans were made from Georgia-Pacific’s parent companies in the US to the Bermuda subsidiary, amounting to $522.1m.

A debt of $636.6m to the Bermuda subsidiary was also written off by Nekoosa Papers, which operated Koch paper mills in the US, in return for two new dollar loans of a similar value. Georgia-Pacific Britain went into liquidation in 2008.

Jack Blum, a lawyer specializing in offshore tax issues, likened the complex money flow set up under the structure to three-dimensional chess. “This is a brilliant piece of tax planning, done by very expensive lawyers,” he said.

“Companies working through steps recommended by the lawyers to minimize tax, putting profits as far away from the tax collectors as you can go. The lawyers … waltz through any number of pathways to make money disappear in this jurisdiction and show up in another jurisdiction where they pay no taxes.”

The Koch brothers have spent years building up a network of rightwing donors as an alternative power base to the Republican National Committee. In the 2016 presidential election, they invested about $250m trying to sway the US Senate and other contests, and have pledged to pump up to $400m into the midterms next year.

Despite minimizing their tax contribution to government coffers, the brothers, each worth an estimated $49.2bn, project themselves as patriots and claim through their primary organising body, Americans for Prosperity, to be focused on increasing the wealth of all citizens.

The Guardian reached out for comment to Koch Industries and Georgia-Pacific but they did not respond.

Sheldon Adelson

The casino magnate Sheldon Adelson gave $100m to Republican candidates in 2012, followed by $77.9m in 2016 and $5m to Trump’s inaugural festivities, according to the Center for Responsive Politics. Information that Adelson has already made public shows he runs three jets in Bermuda, including two Boeing 747s customized for luxury travel.

The planes are operated alongside Adelson’s fleet of 16 private jets in Las Vegas for the use of his company’s executives and VIP guests.

One of the Bermuda 747s is registered to Sands Aviation Bermuda Ltd, and the other to Interface Operations Bermuda Ltd, which is controlled by Adelson and his wife, Miriam. Interface also owns an Airbus A340.

Adelson, 84, owes his estimated $35bn fortune to Las Vegas Sands, the casino empire he built and of which he remains chairman and chief executive. The company owns the Venetian Las Vegas hotel and casino.

His offshore jets are listed in the Paradise Papers, and that in turn has led the Guardian and other news organizations to examine information that he has put into the public domain. It shows that the billionaire has set up a complex timeshare arrangement that allows the Bermuda-based planes to be used by Las Vegas Sands executives.

Filings by the Securities and Exchange Commission (SEC) show that between 2010 and 2016, Las Vegas Sands paid Interface Operations Bermuda $33m for the timeshare on the two jets.

In effect, Adelson’s Las Vegas corporation is paying his Bermuda subsidiary millions of dollars and, in doing so, moving his money into a tax-free environment.

SEC filings also show that in 2012, Sands bought a second jumbo jet from Interface Operations Bermuda for $34m.

Adelson and Sands did not respond to requests for comment.

Geoff Palmer

The billionaire Los Angeles real estate magnate, who has given millions of dollars to Trump and other Republican election campaigns, has an offshore company and a private jet in Bermuda.

Palmer, who once told a reporter “I don’t like paying taxes” and has described affordable housing quotas as “immoral”, last year donated $5m to a Super Pac that supported Trump’s presidential campaign and $310,000 to Trump’s “victory fund”. In 2012, he gave $500,000 to Romney’s failed Republican presidential campaign.

He incorporated a company called Malibu Consulting in Bermuda and, in 2007, transferred the registration of his Boeing 727-21 to the island. The 131-seat jet had previously been registered in Los Angeles County, where property taxes must be paid on aircraft. Bermuda also offers anonymity to aircraft owners, whose identities are disclosed by authorities if they register in the US.

But in an email, Palmer said he paid the same amount in taxes to California as if the plane were registered domestically. “I did not use Malibu to avoid taxes,” he said. “For a host of reasons, mainly for safety, maintenance and convenience, we are better registered in a foreign domain.”

The leaked files show that in 2009, Palmer’s offshore company made moves towards taking out a mortgage on the plane in Bermuda. In their publicly available literature, his advisers tell would-be clients they can help avoid “tax leakage” through stamp duties and other charges.

Palmer, 67, has an estimated personal fortune of $2.1bn. His homes include a $23.6m mansion in Beverly Hills and a $17.3m mountaintop house in Aspen, Colorado.

Thanks to his victory in a 2007 lawsuit against Los Angeles, developers in California cannot be forced to include “affordable” apartments in their new constructions. In 1992, he agreed to pay a maximum $30,000 fine after being accused by a state panel of making illegal campaign contributions.

During a public discussion in 2015, Palmer said his company “haven’t paid federal taxes for the last 30 years”.

Steve Wynn

Steve Wynn, the Las Vegas and Macau casino mogul, became finance chair of the Republican National Committee in January.

In 2004, Wynn’s empire set up, with the help of the law firm Appleby, an intricate loan agreement that tied together a web of corporations across several tax havens to finance a new casino resort in Macau.

The mesh of concerns, details of which were made public to the SEC, linked Wynn’s interests in Las Vegas, Hong Kong and the Isle of Man.

The Appleby files record the Republican donor’s offshore presence in the Isle of Man, Bermuda and the Cayman Islands, and in some cases give frank accounts of the potential tax advantages.

In one of the Paradise Papers, lawyers tell Wynn his businesses are “exempt from taxation in the Isle of Man in terms of the income tax”, a point Wynn Macau Ltd later noted in public filings to the SEC when it declared: “The group is exempted from income tax in the Isle of Man and the Cayman Islands.”

Wynn used to be on frosty terms with Trump, whom he once accused of being “all hat, no cattle”, but he donated entertainments worth more than $700,000 to the president’s inaugural festivities.

He stands apart from a number of his fellow Republican donors in that he has made public several of the key aspects of his offshore holdings through the SEC.

In a statement, his legal representative said: “Wynn Resorts is a public company regulated by gaming licensing authorities in multiple jurisdictions. All assets of the company are fully disclosed in SEC filings, and no assets are or ever have been ‘hidden’.”

The statement added that all Wynn entities, including those offshore, were reported. “For tax purposes, the offshore companies are disregarded and no offshore company has ever been used to hide assets or reduce taxes paid by Wynn in the US or Macau,” it said.

In recent years, Wynn has begun to repatriate a large part of his wealth to the US. In 2010, according to the company’s SEC filings, there was a change of policy relating to his offshore millions.

From that date, the vast sums held by the Cayman Islands subsidiary, Wynn Macau Ltd, was no longer treated as permanently based offshore. The shift came with the twist, however, that the company expected to pay no additional US taxes, as any money repatriated to America would be counterbalanced by foreign tax credits.

By 2015, Wynn’s parent company, Wynn Resorts Ltd, had brought back to the US almost $2bn from the Cayman Islands. As a result, it is impossible to know how much money the gambling empire still has tied up in tax havens.

In an interview with Fox News in October 2016, Wynn said corporations were holding money offshore because “taxes in America are excessively high for businesses”. He proposed that the federal government give companies a tax write-off on the money they agreed to bring back. “Create the job, bring the money back, Uncle Sam won’t collect a dime,” he said.

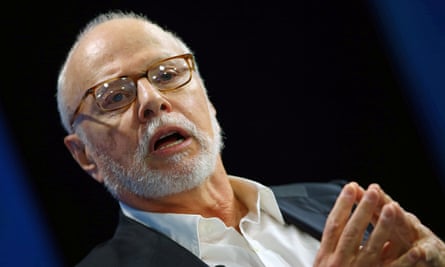

The idea has been adopted by Trump, though the tax rate to be imposed on the returning money has yet to be announced. George W Bush introduced a repatriation tax holiday in 2004, but it had little impact. Much of the $300bn brought back by US corporations was used to hike executive pay.Paul Singer

The Paradise Papers show the lengths to which the major Republican donor, hedge fund manager and “vulture capitalist” will go to extract debt from one of the world’s poorer countries.

The leaked documents contain a paper trail relating to one of Singer’s subsidiaries as it pursued entities in Congo-Brazzaville to try to retrieve debt it had bought at a knockdown price.

The practice of distressed-debt acquisitions is a Singer speciality. The leaked documents add new texture to the pursuit of the Republic of the Congo by the hedge fund manager, who gave $1m to Trump’s inaugural fund.

Kensington International Ltd, a Cayman-Islands-based subsidiary of Singer’s Elliott Management, had bought $57m of debts owed by the Congo-Brazzaville government after it borrowed money in the 1980s.

The debt was to be repaid at 8% interest – a good deal as long as the company could eventually retrieve the money. When it failed to do so, Kensington secured a ruling from a court in London in 2003 that increased the amount Congo-Brazzaville owed it to about $100m.

When the government of Denis Sassou Nguesso did not pay up, Kensington pursued the case in the British Virgin Islands, to the bemusement of a judge who wondered why a Cayman Islands company was pursuing the debt through a different jurisdiction.

In the course of fierce courtroom struggles, representatives of the Republic of the Congo government accused Singer’s company of hiding behind a small offshore subsidiary to shield itself from criticism of its relentless pursuit of one of the world’s poorer nations. Singer’s executives countered that oil was being spirited out of the country illegally to enrich members of Sassou Nguesso’s family.

Congo-Brazzaville agreed to settle its debt in November 2007 for an undisclosed sum. Singer’s company did not respond to specific questions on its activities, though it did point to positive media reports on its work in Africa.