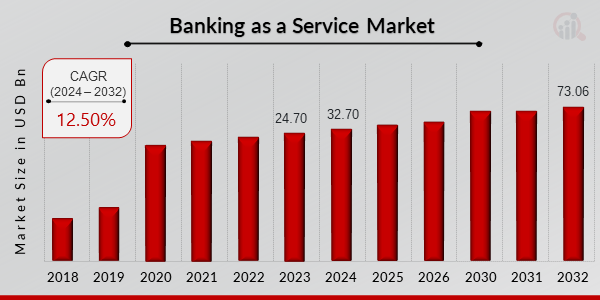

Banking as a Service Market Predicted to Hit 73.06 Million by 2032

Banking as a Service Market Growth

Banking as a Service Market Research Report Information By, Type, Resolution, Distribution Channel, End-User, and Application.

WV, UNITED STATES, February 21, 2025 /EINPresswire.com/ -- The Banking as a Service (BaaS) Market is experiencing rapid growth, driven by the increasing adoption of embedded finance, digital banking, and fintech innovations. In 2024, the market size was estimated at USD 32.70 billion and is projected to grow to USD 73.06 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 12.50% during the forecast period (2024–2032). The market's expansion is fueled by the demand for seamless financial services, API-driven banking models, and partnerships between traditional banks and non-banking institutions.

Key Drivers of Market Growth

Rise of Embedded Finance and Fintech Innovation

BaaS enables non-banking companies (such as e-commerce platforms, retailers, and ride-hailing services) to integrate banking services, such as payments, lending, and digital wallets, into their platforms. This trend is accelerating as fintech firms collaborate with banks to provide seamless financial solutions.

API-Driven Banking Models

The adoption of Application Programming Interfaces (APIs) is revolutionizing the financial sector by allowing third-party providers to access banking services securely. Open banking regulations and API-based infrastructures are enhancing the scalability and accessibility of BaaS solutions.

Increasing Digital Banking Adoption

With a growing number of consumers preferring digital-first banking experiences, financial institutions are leveraging BaaS platforms to offer neobanking services, real-time payments, and AI-driven financial management tools.

Regulatory Support for Open Banking

Governments and financial regulators worldwide are supporting open banking initiatives, encouraging collaboration between banks and fintech companies. Regulations such as the EU’s PSD2 (Payment Services Directive 2) and similar frameworks in Asia and North America are fostering the adoption of BaaS.

Cost Efficiency and Scalability for Businesses

BaaS solutions help startups, SMEs, and large enterprises reduce costs associated with traditional banking infrastructure while scaling financial services efficiently. Businesses can launch banking products such as branded debit cards, credit services, and payment processing without building a full-fledged bank.

Download Sample Pages - https://www.marketresearchfuture.com/sample_request/10717

Key Companies in the Banking as a Service (BaaS) Market Include:

• Solarisbank

• Bankable

• Starling Bank

• Railsbank (Railsr)

• Fidor Bank

• BBVA API Market

• Green Dot Corporation

• Marqeta

• Treezor (A Société Générale Company)

• Synapse

• ClearBank

• BaaS Providers from JPMorgan Chase, Goldman Sachs, and Stripe

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/banking-as-a-service-market-10717

Market Segmentation

To provide a comprehensive analysis, the Banking as a Service (BaaS) Market is segmented based on component, service type, deployment model, enterprise size, and region.

1. By Component

• Platform-based BaaS: API-driven platforms offering banking functionalities.

• Service-based BaaS: White-label banking solutions for fintech firms and businesses.

2. By Service Type

• Payments & Card Issuance: Virtual and physical card issuance, digital wallets, and BNPL (Buy Now, Pay Later) solutions.

• Lending Services: Embedded credit solutions, microloans, and SME financing.

• Compliance & Security Services: KYC (Know Your Customer), AML (Anti-Money Laundering), and fraud prevention.

• Banking & Account Management: Digital account opening, money transfers, and neobanking solutions.

3. By Deployment Model

• Cloud-Based BaaS: Scalable and flexible banking services hosted on cloud platforms.

• On-Premises BaaS: Traditional banking infrastructure managed internally.

4. By Enterprise Size

• Large Enterprises: Multinational corporations integrating BaaS for global financial operations.

• Small & Medium Enterprises (SMEs): Startups and mid-sized firms adopting BaaS to offer banking services.

5. By Region

• North America: Leading market due to strong fintech adoption and regulatory support.

• Europe: Growth fueled by open banking regulations like PSD2 and increased fintech-bank partnerships.

• Asia-Pacific: Rapid expansion driven by digital banking demand in China, India, and Southeast Asia.

• Rest of the World (RoW): Increasing adoption in Latin America, the Middle East, and Africa, with growing investment in digital financial infrastructure.

Procure Complete Research Report Now: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=10717

The Global Banking as a Service (BaaS) Market is poised for significant growth, driven by the rise of fintech innovation, API-driven banking models, and embedded financial services. As more businesses integrate banking functionalities into their platforms, BaaS will play a crucial role in transforming financial ecosystems. With continued advancements in cloud technology, AI-driven banking, and regulatory support, the BaaS market will remain a key driver of the future of digital finance.

Related Report –

Factory and Warehouse Insurance Market

https://www.marketresearchfuture.com/reports/factory-warehouse-insurance-market-33057

Intelligent Virtual Assistant-Based Banking Market

https://www.marketresearchfuture.com/reports/intelligent-virtual-assistant-based-banking-market-33041

Machine Learning in Banking Market

https://www.marketresearchfuture.com/reports/machine-learning-in-banking-market-33033

Musical Instrument Insurance Market

https://www.marketresearchfuture.com/reports/musical-instrument-insurance-market-33663

Real Estate Loan Market

https://www.marketresearchfuture.com/reports/real-estate-loan-market-34157

About Market Research Future –

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research Consulting Services. The MRFR team have a supreme objective to provide the optimum quality market research and intelligence services for our clients. Our market research studies by Components, Application, Logistics and market players for global, regional, and country level market segments enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Market Research Future

Market Research Future

+1 855-661-4441

email us here

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release