Accounts Payable Services Bolster Financial Control for California Enterprises Amid Operational Strains

California businesses boost control and cash flow with expert accounts payable services amid rising costs and payment challenges.

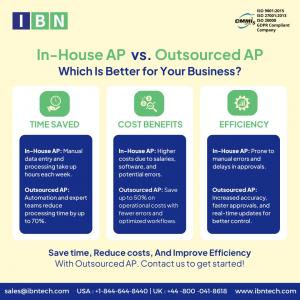

MIAMI, FL, UNITED STATES, May 16, 2025 /EINPresswire.com/ -- As operating costs increase, small and mid-sized businesses in California are using accounts payable services to improve financial visibility, lower human mistakes, and preserve compliance. Business executives may keep control while maximizing cash flow with the help of these services, which include expedited invoice processing, improved vendor coordination, and precise payment monitoring. Decision-makers are using virtual, structured solutions that guarantee speed and security in payment cycles because of the growing complexity of the financial system.As demand increases, several companies are now providing focused solutions that streamline payment processes and seamlessly interact with pre-existing platforms. With its extensive and secure virtual assistance, IBN Technologies stands out among them as one of the most dependable accounts payable solution providers. Their services facilitate stronger supplier relationships and real-time financial insights by decreasing human interaction, expediting turnaround times, and minimizing approval delays. IBN Technologies provides a more affordable and scalable approach than many of its rivals, customized to the changing requirements of small enterprises.

Maximize cash flow with expert AP consultation today!

Claim Your Free Consultation Now: https://www.ibntech.com/free-consultation-for-ap-ar-management

Top Accounts Payable Barriers for California’s Business Community

In an increasingly competitive business environment, effective accounts payable services are critical to ensure financial health and operational continuity. Yet, small enterprises continue to face systemic hurdles. From invoice mismanagement to compliance tracking, the AP lifecycle demands strong procedural control.

1) Limited financial expertise within the organization to manage complex accounting tasks.

2) Internal teams lack the specialized skills needed for sophisticated financial management.

3) Deficiency in qualified staff to oversee detailed financial operations.

4) Inability to efficiently manage advanced financial processes due to skill gaps.

5) Challenges in navigating complex bookkeeping requirements with current internal resources.

To counter these challenges, many businesses seek help from professional accounts payable outsourcing companies. IBN Technologies provides customized solutions to improve efficiency and align processes with industry’s best practices, ensuring California-based businesses stay competitive and agile.

“Operational clarity comes from disciplined processes. The focus is on enabling businesses to offload routine tasks and gain financial control through structured outsourcing.” said Ajay Mehta, CEO of IBN Technologies.

IBN Technologies: Expert-Led Solutions for Seamless Payables Management

As more companies adapt to hybrid work environments and digital frameworks, accounts payable services must evolve to support remote accessibility and real-time financial accuracy. IBN Technologies offers a full-service virtual model for businesses looking to modernize their AP departments. Their services help prevent delays, reduce internal workload, and maintain accountability.

✅ Automated Invoice Capture & Entry

Eliminates manual processing and errors using digital tools for faster data validation and secure input.

✅ Vendor Coordination & Dispute Resolution

Improves supplier communication and handles inconsistencies before they affect payment cycles.

✅ Timely Payment Execution

Ensures scheduled payments via secure channels—checks, wires, or ACH—protecting vendor trust and timelines.

✅ Reconciliation & Exception Handling

Monitors account balances and reconciles payment logs to prevent inaccuracies in financial reports.

✅ Regulatory Reporting & Compliance

Addresses tax obligations and documentation standards to help reduce exposure during audits.

Why Businesses Choose IBN for Accounts Payable Management

Outsourcing accounts payable services allows small and mid-sized businesses to redirect time and budget toward revenue-driving operations. By engaging a reliable provider like IBN Technologies, clients enjoy predictable costs, better audit preparedness, and fewer late fees or vendor issues.

✅ Lower administrative costs than internal teams

✅ Structured workflows for accurate payments

✅ Detailed GL updates for financial compliance

✅ Real-time aging reports to aid decision-making

✅ Advanced digital tools reduce human errors

In the face of growing accounts payable challenges, expert-driven support becomes essential for managing complexities. IBN Technologies bridges the gap between traditional processing and agile business needs.

Client Outcomes: Real-World Results

IBN Technologies has proven its expertise in improving financial operations for small and mid-sized businesses. Through its outsourced accounts payable and receivable services, the company has consistently achieved measurable results across various industries.

1) For example, a U.S.-based retail SME cut invoicing delays by 85%, saving $50,000 annually thanks to IBN Technologies streamlined processes.

2) Likewise, a manufacturing company in Illinois experienced a 92% boost in payment accuracy, greatly enhancing supplier relations and operational efficiency.

By reengineering the account payable procedure, IBN Technologies delivers more than task completion—they bring long-term efficiency and vendor trust.

The Path Forward: Future-Ready Accounts Payable Support

The transition to comprehensive accounts payable services becomes an operational necessity as California firms continue to face supply chain disruptions and cost volatility. These solutions enhance visibility, transparency, and scalability in addition to supporting timely payouts.

Among the top accounts payable outsourcing partners, IBN Technologies continues to set the standard by offering flexible packages customized for startups, SMEs, and growing businesses. Their human-driven, technology-forward strategy blends customization with security, assisting customers in achieving financial resilience, resource optimization, and change management.

Related Services:

Outsourced Finance and Accounting

https://www.ibntech.com/finance-and-accounting-services/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

LinkedIn

Instagram

Facebook

YouTube

X

Distribution channels: Banking, Finance & Investment Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release